Can’t Sell Your Home In This Market? Rent Instead!

“It’s Dejavu all over again” (Yogi Berra)

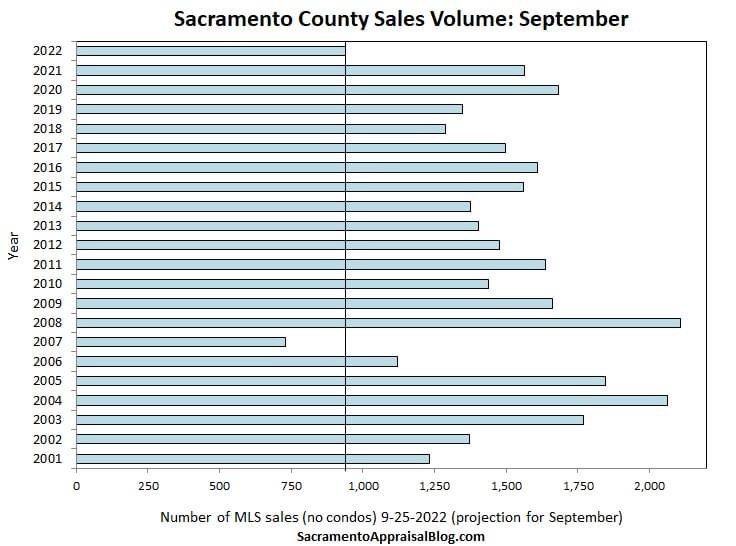

When the sales market collapsed from 2007-2012, many property owners decided to rent rather than sell in a declining sales market. We have entered a similar market now. September 2022 sales are the lowest in over 20 years, with the market crash of 2007 being the only exception. More than half of the properties on the market today have reduced the list price.

We encourage you to consider retaining ownership of your asset in this declining market, and here’s why:

Rent values have increased dramatically:

Rent values are up a staggering 80-100% over the past 10 years. Current rent values will often cover the full cost of the mortgage, taxes, and insurance. Rental properties are also in high demand and there is good reason to expect rent values to hold or continue to increase even in a recessionary economic cycle. Click HERE for a free analysis of your home’s current fair market value.

The most common way to build generational wealth in America is with real estate:

The most affordable property to buy is the one you already own! You probably have a fantastic interest rate and there are no closing costs, inspection, or appraisal needed. Real estate tends to be a hedge against inflation, as rents and home values tend to track well with inflation over the long haul. Allow the tenant’s rent to cover your mortgage and create residual income for you and your posterity.

You have an incredibly low-interest rate:

The 2.8% to 4% interest rates most homeowners have are unavailable now. Even if real estate values drop for a while, the beauty of having a very low-interest rate on your existing home is something well worth holding on to. Those rates may not come back for years – or decades. The Federal Reserve Board raised interest rates by ¾% yesterday and has plans for several more increases this year in an effort to curb inflation. Your existing low-interest-rate loan has become extremely valuable.

Tax benefits and considerations:

- Repairs, utilities, and maintenance: When you convert your private residence into a rental, you pick up some valuable tax write-offs. Repairs and updating done to get your property ready for the rental market are typically deductible. Services such as water, sewer, garbage, gardener, or pool service paid by you may also be written off. Ongoing repairs, maintenance, and professional property management fees are also tax write-offs.

- Capital gains tax: When you sell your private residence, there are no capital gains taxes. Capital gains tax varies depending on your income and other factors, but it commonly runs 24% of the gain you have had since you purchased the property. The rule for exemption is that you must reside in the home for 2 of the past 5 years before you sell it. This means you can convert your home into a rental and still sell it exempt from sales tax if you sell it and close escrow within 3 years of the time you moved out.

- 1031 Tax Deferred Exchange: If you decide to hold your property long-term as a rental, a 1031 exchange option is available, which allows you to sell one investment property and exchange it for another – deferring the capital gains tax.

NOTE: Tiner Properties is not a tax expert and we recommend you to seek the advice of a tax expert for your specific situation.

DIY Property Management is not as easy as it used to be:

New rental laws have made property management complex. In the past 3 years we have seen a plethora of new rental laws: Rent control with AB 1482, the COVID eviction moratorium and the Rent Relief program, Changes to the Housing voucher program (Section 8), Marijuana laws, ESA (Emotional Service Animals)… Hiring a Professional Property Manager who stays current with all the changes will significantly reduce the risk of owning a rental property. Case in point: Tiner Property Management manages 800+ homes. During the full COVID eviction moratorium we only had 5 tenants fall behind on the rent. We received full rent back from the Rent Relief Program on 4 of those tenants and evicted the other tenant. Our vacancy rate was also under 1% during the full 2.5 years of the pandemic. Great rental statistics are not luck, they are the result of excellent tenant screening and operating with the best practices possible.

Professional Property Management:

If you would like to grow your wealth by retaining ownership of your valuable real estate investment, it is imperative that you secure professional management. We would love the opportunity to share more information about our unparalleled service with you. Established in 1976, Tiner Property Management is a well-oiled machine with the primary function of protecting you and your investment property while generating a maximum return on your investment property. We are experts at thorough tenant screening, precise accounting, detailed inspections, and understanding property management law. Contact us today at 916.402.3095 or management@tiner.com for more information, or to schedule a free, no-obligation meeting. We look forward to getting to work for you. Professional Property Management doesn’t cost… it pays!