Rental Market Update, 3rd Quarter 2024

After 7 boom years in the rental market - we have now had 2 slow years with a softening market. The change is largely due to increased interest rates.

In 2022, interest rates more than double (3-7%) and that wiped out about 30-40% of the typical sales market since then. Some of the 40% preferred to have the “golden handcuffs” where they cannot afford to move due to the higher interest rates, so they stay where they are. But a high percentage became “Plan B” or “Default landlords”. They said, “We can’t sell so let’s rent.” …as they should have - because it makes good sense to keep their 3% home loan.

Over the last 2 years we have been getting multiple calls a day from property owners who wanted to sell - but are considering renting their homes instead. All those properties coming onto the rental market have resulted in softened rent values.

SFH (Single Family Home) rental data is difficult to obtain. Fortunately, Tiner Properties management has maintained Weekly Vacancy Report data for over 18 years. We track things like: Vacancy Rate, DOM (Days on Market), Calls & Emails, Showings, and Applications Received … and share those Weekly Vacancy Reports with our owners who have a vacancy. This is great communication, and it helps us analyze if we need to adjust the asking price. With nearly 1200 homes managed now, our portfolio is a good representation of what is going on in the Sacramento SFH and duplex rental market. I looked back at our June averages for the past 4 years and the results are telling:

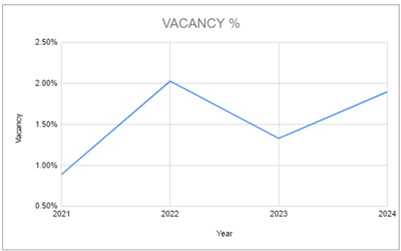

SFH Vacancy rates roughly doubled from 2021-2022 …and have remained high.

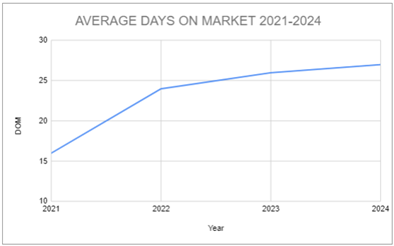

Days On Market are up 40% from 2021:

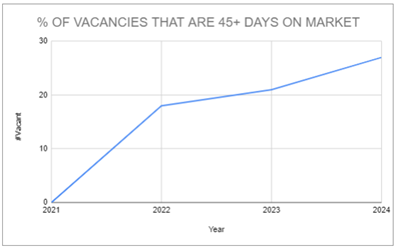

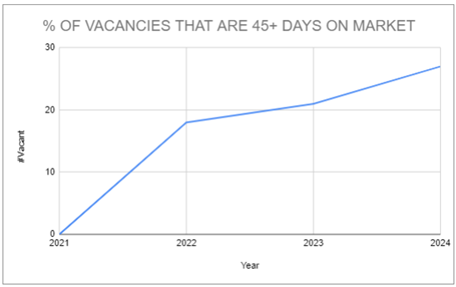

Long term vacancies were almost non-existent in 2021 - and are now about 25% of all vacancies:

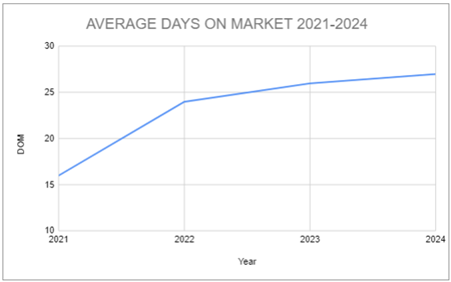

Days On Market are up 40% from 2021:

Long term vacancies were almost non-existent in 2021 - and are now about 25% of all vacancies:

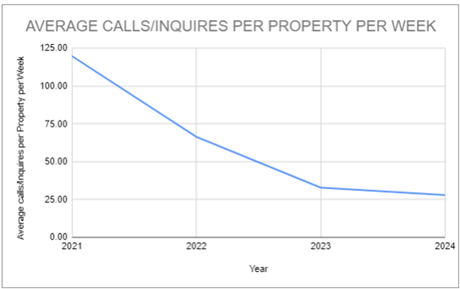

Calls/Inquiries per vacant property are down by 78% over 4 years:

We are receiving 3x less interest for properties than we did 3 years ago!

Keep in mind that Tiner statistics are better than the actual market stats: For example, our vacancy factor is just under 2% now - but Sacramento area vacancy rate is 4-5% depending on the data source used. DOM and long-term vacancies are much worse in the open market - our success is due to our excellent marketing, an outstanding leasing team, and our regular communication with our property owners so we can adjust properties that do not rent quickly. Having said that, Tiner stats over time are a good indicator of how the market is performing - and how it is trending - in the Sacramento area.

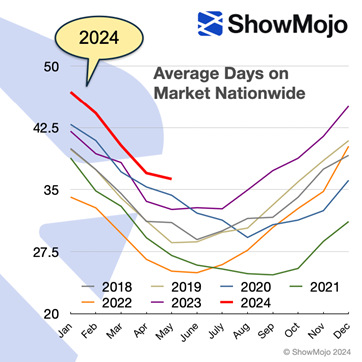

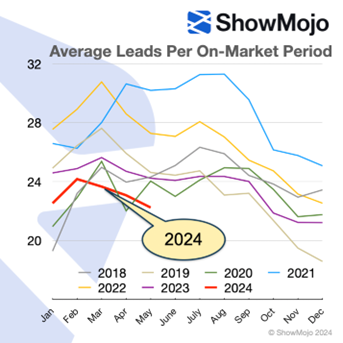

National statistics mirror Tiner data trends.

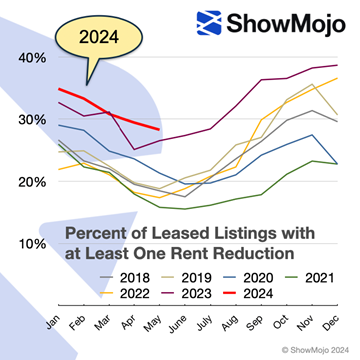

The following graphs are from ShowMoJo which tracks rentals statistics nationally:

Both Tiner data and the National data are pointing out what we are seeing every day. The rental market is soft (not impossible) and it is imperative to market and price rentals well in order to find tenants now.

So, how does a landlord properly price a rental?

Many property owners look to Zillow rent "Zestimates". Depending on the area and amount of updating any given property has, those rent estimates are a good general indicator. At Tiner Properties, we look up Zillow rent Zestimates along with some other tools we have - but we know that Zillow rent estimates run higher than real rental market values. I took a look back at the last 150 homes we rented, and compared our actual data to Zillow rent “Zestimates” at the time we rented our properties. We found that Zillow rent estimates averaged nearly 12% higher than our actual rent value.

What is a “rental comp”? Landlords often refer to rentals on the market as “rental comps” (comparisons) - much like Realtors use “sales comps” to establish current market sales value. There is a substantial difference: Sales comps are actually sold properties which are public record. The rent comps are what other Landlords are ASKING for rent - not what they actually rented for. National data indicates about 30% of all vacant rentals have at least one price reduction. Sometimes what looks like a comp may only be a property with way too high an asking price to actually rent to a well-qualified renter.

Conclusion:

All key indicators tell us that we are in an increasingly soft Single Family Home rental market. If you are a landlord suffering with a difficult vacancy, here are some of the things that I suggest you consider:

Consider allowing pets: Pet Friendliness is on the rise: 57% of rentals nationwide allow pets. Nearly 70% of all tenants have pets. Allowing pets can significantly increase the applicant pool available and reduce the length of a vacancy.

Emphasize lease renewals: The best way to cut down on your vacancy factor is to keep tenants on leases - don't just let them roll over into Month to Month tenancies. Tiner Properties does a great inspection at the 10 month anniversary of each lease - and that timing is key. We want eyes on the property to see if the tenant has snuck in pets or people - or if they are great tenants that we want to keep. Most are great, so we work hard to come to terms on a lease renewal whenever possible.

There are 4 main factors that cause rentals to rent or sit vacant:

- PROPERTY CONDITION: You can’t attract “A” quality tenants to homes in “C” or “D” condition. So get your home looking good. Shape up the yard and keep a gardener on it. Be sure it's really clean, the paint looks good, and everything works. Update if needed.

- GREAT MARKETING: If your home is in good condition but no one can find it, you will fail. It's really important to have professional quality, well lit pictures. Tiner’s listings all have beautiful photos and are published to all the relevant rental websites.

- TRACK RESULTS: Tiner Properties keeps track of how many calls we get on each property, and how many showings, and how many applications. Tracking the data will inform your marketing and pricing, if you pay attention to it.

- FAIR PRICING: If you've done all you can to make the condition nice, and it's well marketed, then the 3rd leg of the tripod is pricing - and this is the one you need to adjust until you start getting good showings and applications.

The 5% principle: On a $2,000 rental property, if it takes an extra month of vacancy to get $100 more rent, a property owner will not break even for 20 months.

Price your rental to attract the best applicants: When a rental is priced too high, “A” applicants move on to better values and we get more “B, C and D” applicants. “A” applicants are the smart ones - they have great credit and rental history. We want to attract “A” applicants so sometimes that means being a little lower than others are asking for rent – especially in a declining market like we have now.

Understand the “Sticky Factor”: Even if you have to drop the rent more than you wanted to get a good tenant now, understand that you can catch it up with a rent increase at the end of a year. If the market supports it, you can raise them 10% next year and very few tenants will move over a 10% increase.

Listen to an expert: Expert property managers rent homes every day and know how the market is changing. Lean into their experience and take their recommendations for pricing.